The information revolution disrupts global markets at a pace never seen before. The reason derives from a unique economic model.

The last generation has been era of huge growth for the hi tech industry. Young companies, never previously existed, has become global giants. More and more start-up companies receive a “unicorn” worth of 1bn dollars or more, making the entire phrase’s point, of being rare to the level of unreal, well, inaccurate. Yes, there’s an actual common phrase for a new company unimaginable worth. The tech industry is boiling up, looking at cases like Facebook, Instagram and WhatsApp (now all merged) that exist not more than a decade and a half. All in all, technology’s fast pace growth generates numerous opportunities, with an outstanding potential.

This outstanding potential derives from the visison of major changes expected from these new companies: a new product that may replace existing market leaders, lowering costs, reaching a bigger audience and taking the lead. This concept is known for some time as “disrupt”. Netflix and Amazon in recent years, Google and Facebook in the previous decade and Apple and Microsoft in the generation before, all did the exact same thing: they have completely disrupted the markets they entered in to and enlarged them substantialy, practically by re-inventing them

The added value from disruption, in this vastly growing tech industry, is the drastic decrease in costs of information. Computing and communications – the internet, costs close to nothing, marginally, both for the general public and for tech companies. And for that cost of “nothing” service levels rise exponentially. In turn, that cost savings source allows start-ups to offer their own services, in any new market they enter, with a marginal cost of zero.

If the marginal costs are close to nothing, then, as some may say, fixed costs should receive a higher weight: computer equipment, and more importantly top-developers wages costs. Those would directly affect the Average cost, and that cannot be ignored. But here’s the thing, Average costs tend to get very low at high quantitive volumes. The same goes for marginal costs, that, as said, are close to nothing to begin with.

This means that even low market share might cover costs for a growing company.

Trying to implement this logic on the simple supply curve and the equilibrium economic model, brings us to an interesting result:

In the general case,

The single firm’s supply curve is defined as its marginal cost (MC), as long as MC is above its average cost. A firm would not sell below its average cost, since it would lose money. Mathmatically we can define the supply curve, for the single firm, as S = MAX(AC, MC)

A market supply curve is built as the average marginal costs (MC) of all of the firms in the market.

When the MC is equal or higher than the average cost (AC) The marginal cost increases, as a result of the opposite effect of marginal production. In short: firms will sell at their lowest possible cost margin, even if costs increase. Evantually, we get a supply curve that’s rising from left to right: higher cost per rising quantity

Unlike the general case, our basic assumption, for this discussion, is that MC = 0.

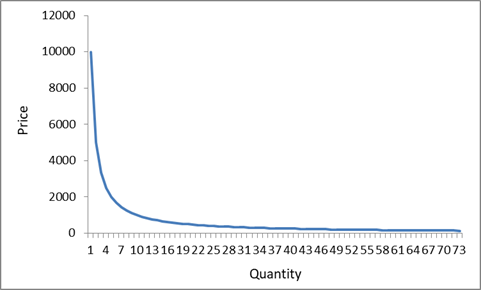

In the case of zero marginal cost, the supply curve equals to AC, and since the AC is dropping, because fixed costs do not change as a result of quantity, we’ll receive a curve that’s dropping from left to right: lower cost per rising quantity

The other conclusion from the basic assumption is that the production function, under the costs limitation, is completely unaffected by quantity.

To put in simpler words: it costs the same to produce 100 units and 1000 units.

So, if the Total costs function, as a function of quantity, is fixed, then the average cost function must be:

AC = TC/x.

In that case, as said, we’ll get a very special supply curve: It will rerun a lower price as a result of increasing quantity, and it will aspire to zero. always.

The impact of such a basic fundamental element of economy has huge implications on another basic concept: market equilibrium

Assuming that demand remains the same, using our new supply curve, a new equilibrium will be established. And when, for example, when a fix cost investment takes place, such as technological improvement, due to R&D, the equilibrium, following the supply curve, will change significantly, making the product even cheaper

Needless to say that older technologies based solutions become irrelevant, but the model shows that even relatively new technologies can quickly be rendered obsolete.

Furthermore, if the market in question is business to business (B2B), then a ripple effect will take place on the value chain: lower product price in the B2B market will lower production costs for businesses using it to create the own product, and so on.

As an example, we can look at cloud services:

In the time before cloud services became a common service, not so long ago, local file backups and management was costly. Regardless of hard drive capacities, maintenance took alot of indirect resources: physical management, systems and networks engineers, etc. High level storage capabilities were beyond the scope for small and medium size businesses, even though information was critical then too.

With the emergence of cloud services, a simple subscription and possibly a software installation is all that was required. Not only was the expense for the internal operating costs decreased, but the quality surpassed anything that might have been accomplished in-house.

Since 2010 (even before), cloud services boomed, luring tech giants such as Microsoft, Google and Amazon.

The source of this enormous growth, came directly from the costs decrease in cloud computing services, as an alternative to previous technologies and then to itself. Any prior technology has been wiped out completely, as a result.

https://medium.com/@Unfoldlabs/8-trends-in-cloud-computing-for-2018-d893be2d8989

Interestingly enough, market growth did not come only from the existing demand for these services, when cloud services came to be. Due to the massive cost reduction, doors opened for new companies demanding cheap file management services: first of all pretty much any new start-up out there, followed by any company looking for web services, but not only. Any data consuming business became a customer. That can apply to pretty much any business out there, households too.

https://www.statista.com/statistics/500541/worldwide-hosting-and-cloud-computing-market/

So what will be the next giant market, and who shall invent it?

The possibilities with the current status of the information revolution, in my opinion is far from being fulfilled. Not only businesses constantly improve in existing markets, 3rd world countries still need to catch up to today’s tech. And of course the next technological big jumps (5G, IoT, fintech, medtech, etc) are just speeding up

Continue reading: Start-Up economics: the disrupt model